Law.com legal forms guide provides the form I 1120s for business corporation tax return for S corporations and limited liability companies operating within Rhode Island. This form can be found on the website of the Rhode Island Division of Taxation. To complete the form, follow these steps: 1. At the top left, check the next to all applicable descriptions of your return. 2. If you are filing on a fiscal year basis, indicate the starting and ending dates at the top of the form. 3. Provide your business name, address, federal employer identification number, and telephone number. 4. Enter your gross receipts, depreciable assets, total assets, and Rhode Island Secretary of State ID number. 5. Enter your federal taxable income on line one. 6. Complete schedule B on the second page and transfer the number from line 2d to line three on the first page. 7. Complete schedule C on the second page and transfer the number from line 4e to line five on the first page. 8. Subtract line three from line one, then add line 5 to the resulting difference. Enter the result on line 6. 9. Complete schedule J if your business operates in multiple states to determine your Rhode Island apportionment ratio. Transfer this rate to line seven on the first page. Multiply line 6 and 7 and enter the result on line 8. 10. Complete schedule H to fill out line nine on the first page. 11. Enter all payments already made on line 10. Calculate your balance or refund as instructed on lines 11 through 17. 12. An authorized officer of the corporation should sign and date the form and provide their title. For more information and instructional videos, visit laws.com.

Award-winning PDF software

1120 nd Form: What You Should Know

U.S. corporation and certain S corporations. The form is also used to prepare the federal and Nebraska federal income tax returns. Form 1120-SB — S corporation return Use Form 1120-SB, U.S. S Corporation return to report the income, gains, losses, deductions, credits, and to figure the income tax liability of an S corporation. The form is also used to prepare the federal income tax returns. Form 1116 — Schedule SE, Subpart N Form 1116 Instructions Use Form 1116 to record the income, gross profit, adjusted gross profit, deduction and credits for operating business of any other businesses (including partnerships) that you do not have to file separately. Form 936 and 936-B — Nebraska Schedule SE return Form 936 and 936-B, Nebraska Schedule SE Return instructions are the same as for the state income tax forms. Form 954-D — Nebraska Schedule SE Return to Reporting an Itemized Deductions See how Form 944, Report of Changes in Accounting Methods, is used to claim itemized deductions for taxes owed by an organization. Form 941 — Nebraska Form 941 for Non-S Corp Businesses Form 941 instructions are identical to Form 944, Report of Changes in Accounting Methods. Form 944 — Nebraska Schedule SE This form includes the amounts for income, employee and business-related taxes. It also covers itemized deductions if the organization must itemize. Form 944 instructions are identical to form 941 instructions. Form 944-T — Schedule S-T, Part B, with Transfers Form 944-T instructions are same as Form 944 in the state of Nebraska. Form 944-T, Nebraska Schedule SE Return Form 944-T, Nebraska Schedule SE Return instructions are the same as the state of Nebraska. Form 959 and Form 3115 — Nebraska Self Employment Tax Returns Form 959 is for any wages reported on a Form W-2 for a mayor that receives income from employment. Forms 3115, Employee Contributions to Health Savings Accounts, are for any contributions made to a health savings account. A tax return is also required for any employer who does not report wages but receives a cash payment for services performed. NU Tax Information Form 951 and Form 709 — Nebraska Individual Income Tax Return Form 951 includes the total gross income reported on a Schedule K-1.

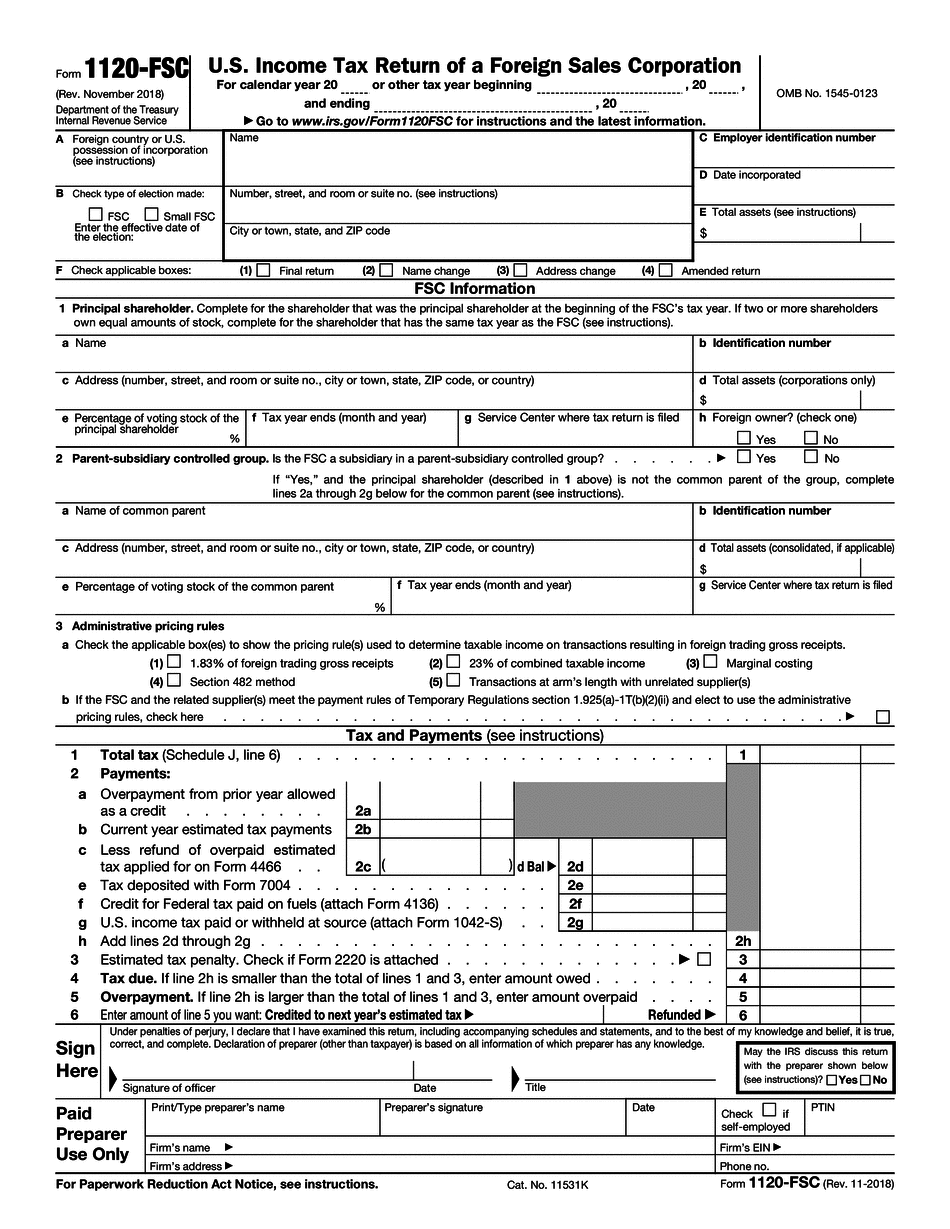

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-FSC, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-FSC online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-FSC by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-FSC from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1120 nd