Well, my name is Brett Hersh. I'm an instructor for Overnight Accountant. I would like to introduce you to our course, Form 1120 H Basics. Now, if you're watching this video, you probably already know that all HOAs across the United States are required to file a tax return every single year. But, did you know that the vast majority of HOAs are required to file a form called Form 1120 H? Now, this form is expensive to prepare if you hire a professional. They're going to charge you $250 or more every single year to prepare this return. However, it is a relatively simple return for the vast majority of HOAs, that they can actually complete on their own with a little instruction. Which is why we created this course, Form 1120 H Basics. So, what does the course cover? It covers how HOAs qualify to file Form 1120 H, how to complete Form 1120 H on your own, and then how to properly and timely file that form. We even have a real-world example with step-by-step instructions on how to prepare Form 1120 H. It's a real-world example. So, what comes with the course? What does it include? It includes access to articles and the PowerPoint we use in the course itself. We have a weekly "Ask a Question" section, so if you run into an area where you have a question, check the FAQ. But, if you don't find the answer, you have the ability to ask questions to an instructor to help you prepare your own Form 1120 H. What are the benefits of the course? You're going to understand HOA rules and tax regulations. You're going to keep your HOA compliant with the tax authorities. You're going to save your HOA a ton of money....

Award-winning PDF software

Irs 1120-h 2025 instructions Form: What You Should Know

Form 990-EZ, U.S. Income Tax Return for Small Businesses, 2025 – 2017. 2018 Instructions for Form 990 — IRS Filing a corrected Form 990 will help keep your taxes from piling up. Use Form 990-EZ, U.S. Income Tax Return, for details on how to file a corrected Form 990. For form 990-PF, U.S. Income Tax Return for Persons Other Than Taxpayers, 2018, 2018, 2025 tax year. 2018 Instructions for Form 990PF — IRS A tax return is one of the two major financial documents we file to get the IRS to calculate our tax liability. The other is our W-4, Wage and Tax Statement, which shows our income, your employee's compensation (if you provide information to determine who receives that compensation) and the value of your qualifying business property. Find information on how to prepare and file Form 1040, U.S. Income Tax Return for Individual. For the 2025 tax year, 2025 Forms 1040 and 1040A are both due April 15, 2018. They may have to be filed in different installments; or Form 1040A may be filed for May, August or October. Learn about the other pages of federal income tax forms that you need to file, plus how to find out how much tax you can owe, when you can expect payments to arrive, and how you should prepare your return.

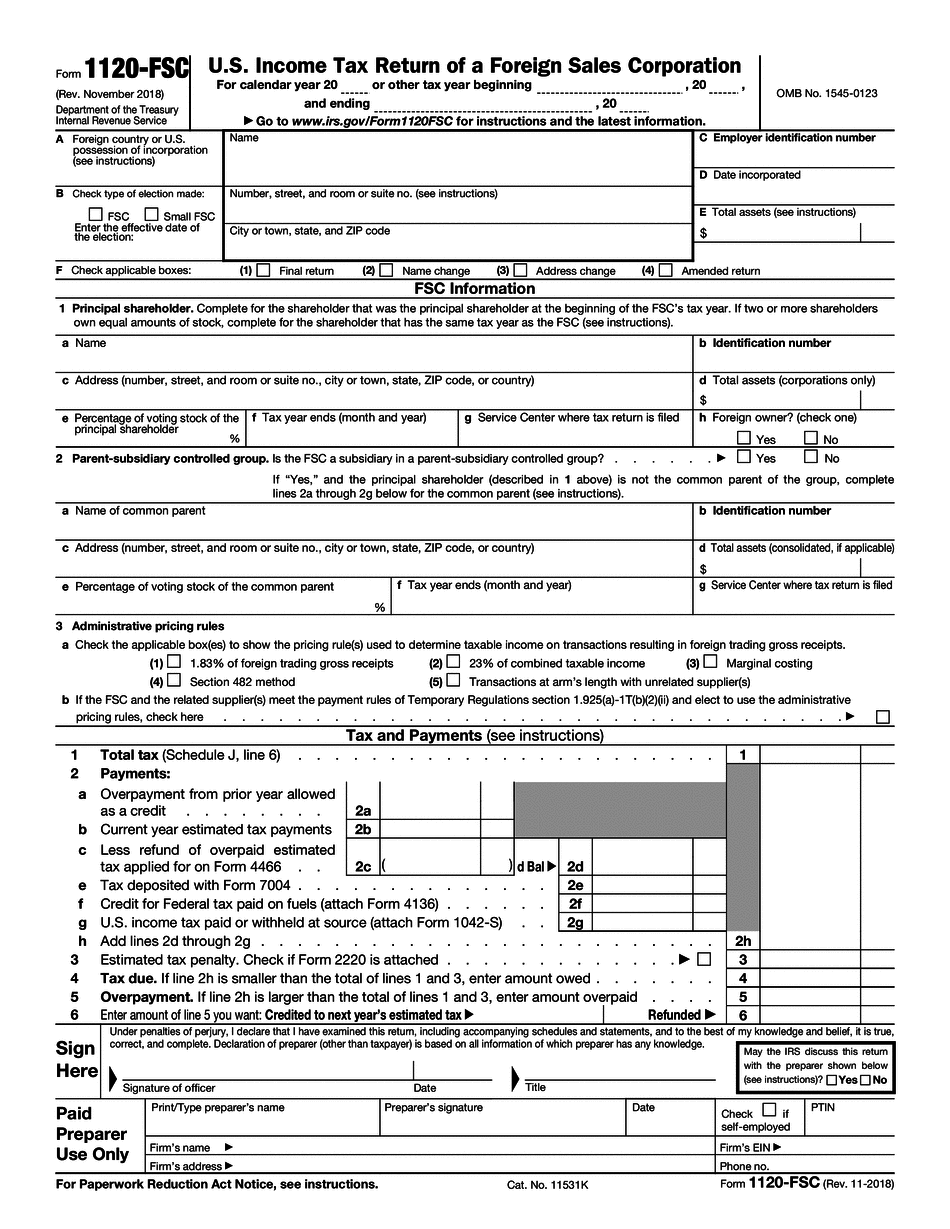

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1120-FSC, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1120-FSC online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1120-FSC by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1120-FSC from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs form 1120-h 2025 instructions